Understanding Money Mindsets

Your approach to spending, saving, and investing often originates from deeply rooted beliefs and attitudes about money. This collection of beliefs is known as your money mindset, and it impacts nearly every financial choice you make. How you feel about wealth and your ability to accumulate it may seem like a subtle influence, but it actually has a significant impact on your daily actions and long-term financial trajectory. Whether you’re conscious of it or not, your mindset can propel you toward prosperity or keep you from reaching your potential. Navigating financial growth requires self-awareness, and for those looking to hear real stories and solutions from others, check out the Dow Janes reviews, where individuals share their experiences overcoming money mindset blocks and making transformative progress.

Experts agree that your mindset has a significant impact on the financial decisions you make daily. These mental scripts develop early, influenced by family, environment, and cultural narratives that may emphasize financial caution or, conversely, risk-taking and abundance. Sometimes our earliest memories about money—whether our parents discussed bills openly or avoided talking about finances—shape our comfort level as adults. By becoming aware of these subconscious patterns, you can identify behaviors that may be limiting your financial growth and begin to cultivate healthier, more productive financial habits, ultimately transforming your long-term economic outlook.

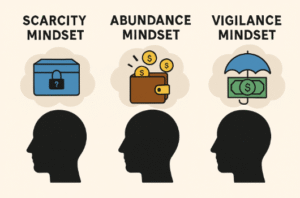

Common Money Mindsets

Certain money mindsets recur frequently and can have a profound influence on financial behavior. The way you perceive opportunities or threats in your financial environment has a direct impact on everything from making big purchases to deciding whether to invest for retirement. While the names of these mindsets vary, the themes are consistent across cultures and backgrounds:

- Scarcity Mindset: Viewing money as a limited resource can lead to stress, risk aversion, and habits such as hoarding cash or fearing loss. Individuals with a scarcity mindset may focus more on what they could lose rather than what is possible to gain, possibly missing out on growth opportunities. This mindset can be exhausting over time, fostering anxiety about the future and a reluctance to pursue new experiences that require financial confidence.

- Abundance Mindset: Believing in plenty of opportunities helps individuals embrace new ventures, invest with confidence, and seek financial learning. This mindset is associated with greater financial satisfaction and success. People who cultivate an abundance mindset tend to believe that there is enough money and success to go around, which leads them to share opportunities, network enthusiastically, and recover more quickly from setbacks.

- Money Vigilance: Individuals with this mindset approach money cautiously, prioritizing savings and being cautious about debt. It often correlates with healthier account balances and lower levels of impulsive spending. Money vigilance can encourage sensible frugality, but if taken too far, it may prevent an individual from enjoying the money they’ve worked hard to accumulate or investing in their own happiness and growth.

Understanding your mindset is essential for personal growth and modifying unhelpful beliefs. Behavioral finance studies show that increased awareness can lead to cognitive shifts and better financial outcomes. Recognizing habitual patterns enables the formation of new habits, which significantly influence budgeting, saving, investing, and spending behaviors. A scarcity mindset may lead to excessive frugality and missed investment opportunities, while an abundance mindset encourages resilience and the pursuit of financial goals despite obstacles. It transforms challenges into opportunities for innovation and advice-seeking, fostering a proactive approach to financial stress. Ultimately, a growth-oriented mindset can enhance both financial situations and overall financial well-being.

Shifting to a Positive Money Mindset

Adjusting an ingrained money mindset is possible with patience and intention. Just as negative beliefs take years to manifest, building new mental habits takes time and conscious effort. Consider this four-step process for real and lasting change:

- Self-Reflection: Take inventory of your money beliefs. Ask where these attitudes come from and whether they still serve you. Reflect on formative experiences and be honest about how they influence your present behavior.

- Education: Increasing your financial literacy builds confidence. Learning how to manage money, navigate investments, or reduce debt are all skills that can be learned, regardless of where you start. Accessing resources can provide practical steps for both beginners and seasoned savers.

- Goal Setting: Setting specific, measurable goals makes progress tangible and motivating. Break your ambitions into actionable milestones and celebrate each win. Whether you are striving to save an emergency fund, buy a home, or launch a side business, rewarding progress keeps you moving forward.

- Positive Reinforcement: Acknowledge small successes. Rewarding yourself for incremental changes keeps you focused and motivated through setbacks. Simple gestures, such as treating yourself after reaching a savings target or sharing milestones with friends, can reinforce better habits.

The Role of Financial Education

Financial education is a game-changer for money mindsets. The more you know, the harder it is to fall back on old, limiting beliefs, because information replaces misinformation. Research highlights that those with higher financial literacy are less likely to engage in unplanned spending and more likely to save and invest for future goals. Education provides the language and tools necessary to navigate a range of financial decisions, from everyday budgeting to sophisticated investment choices, thereby helping to demystify financial markets and products. Formal education, workshops, and self-directed learning are all effective paths to achieving greater confidence and better financial results. Proactive engagement with financial content helps replace anxiety with knowledge and can shift your mindset toward financial empowerment.

Real-Life Examples of Money Mindset Shifts

Consider those who have changed their futures by transforming their relationships with money. For instance, someone who grew up in a financially insecure environment may initially avoid investment risks. Through education, self-awareness, and support from mentors or community groups, they replace a scarcity narrative with an abundance perspective, taking meaningful steps toward investing, professional development, and long-term financial security. Over time, as their mindset shifts, their actions follow, and economic freedom comes within reach.

Another example: an individual who is fiercely vigilant with their savings may realize the benefit of balance—becoming comfortable with calculated investments, charitable giving, and even spending on meaningful experiences, thereby enriching both themselves and their communities. These stories show the transformative power of mindset shifts and highlight that change is possible at any stage of life.

Conclusion

Understanding and reshaping your money mindset is central to building resilient and rewarding financial habits. By examining your beliefs, expanding your knowledge, and setting motivating goals, you unlock new possibilities for achieving financial freedom and overall well-being. Every step toward a positive money mindset helps lay the groundwork for lasting economic success and a more confident future. It may take time and effort, but the long-term rewards of a healthy money mindset—both material and mental—are well worth the journey.

Leave a comment